What Goes Up, Goes Down Slowly: A Long Road to Recovering Job Losses in Minnesota

With new unemployment numbers set to be released on Thursday, Minnesotans are bracing for news as to whether the state will continue to follow the leveling-off pattern of job losses from the last 3 months, or whether unemployment will rise closer in line to the nation overall (currently at 9.5 percent).

In January and February of this year, the Gopher State was tracking the national jobless rate very closely – just 0.1 percentage point below the U.S. level at 7.5 and 8.0 percent respectively during those two months.

At that point, while the national jobless rate continued to rise – 8.5 percent in March, 8.9 percent in April, 9.4 percent in May, and 9.5 percent in June – Minnesota’s rate has been fairly flat: 8.2 percent in March, 8.0 percent in April, and 8.2 percent in May.

However, even if the Minnesota economy has bottomed out of its current crisis and is starting to rebound, history suggests it will take years, perhaps even a decade to fully recover from all the jobs lost during the recent recession.

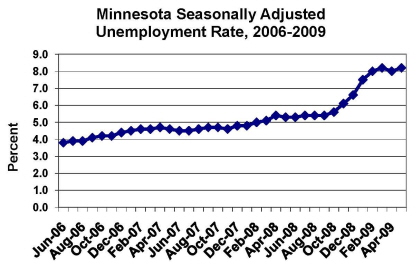

Although the unemployment rate did not really begin to make headlines in the Gopher State until after the November election (rising a half a percent in both November and December), the current upward arc in state job losses began all the way back in June 2006. At that time, the seasonally adjusted unemployment rate was just 3.8 percent. However, over the course of the next 35 months, the rate increased in 21 months, held steady in 9 months, and decreased in just 5 months.

As a result, by June 2007 the jobless rate was up to 4.5 percent. By June 2008 it reached 5.3 percent. And, by May 2009 it reached 8.2 percent.

While this rate of increase in unemployment has been unprecedented, there is no guarantee that the rate of decrease in job losses will be quite so swift. In fact, recent history suggests the recovery will take a much longer time to play out.

The last time Minnesota’s unemployment rate was at its current level of a shade above 8 percent was May 1983 (8.3 percent). At that time, the Gopher State was already in the midst of a recovery from the recession in Ronald Reagan’s first term where peak jobless levels in Minnesota reached 9.0 percent in November 1982.

The escalation of Minnesota’s unemployment rate had only taken a bit longer to reach the 8+ percent mark during that economic crisis – rising from 3.8 percent in March 1979 to 8.0 percent in June 1982: a period of just 3 years and 3 months (it took 2 years and 8 months during the current recession to escalate that quickly).

However, after declining back down to 8.3 percent in May 1983, Minnesota did not return to the pre-recession unemployment rate of 3.8 percent until November 1994 – some 11 years and 6 months later.

At that rate (assuming Minnesota has reached its peak jobless levels now), Minnesota will not see the return to its 3.8 percent pre-recession unemployment level until November of 2020.

Continue to visit Smart Politics for more in-depth historical analysis of the economic recessions facing Minnesota, Iowa, Wisconsin, and the Dakotas.

Follow Smart Politics on Twitter.

It took over fifteen years for this to come to critical mass. Now that the current housing bubble has deflated, we are seeing just how much of an impact it can have on our economy.

Construction industry, suppliers,equipment and the home furnishing industry along with retail all dovetail together when measuring these employment numbers.

Then of course the over expansion of commercial real estate. Empty offices building, retail centers filing for bankruptcy. Even divisions of OPUS are filing for bankruptcy.

Not to be an apologist for the president, but I would hope that most reasonable people will not think that this will be solved in six months or in a few years time.

All we know is the current economy can’t “recover” because it can’t go back to where it was before the crash. So instead of asking when the recovery will start, we should be asking when and how the new economy will begin.

I think that comparing to the past is pretty irrelevant because of the radical change in the labor market with the inclusion of China, India and other smaller countries in direct competition with the United States. A billion and a half people entered our labor market, which will drive down wages and demand for labor in the United States. You have to layer on top of that a one-party country desperate to stay in power and willing to undercut labor costs in other countries and shackle exports for the marginal improvements in its country. There is also the Internet, the full force of which is finally hitting. The recording industry, the print media, bookstores, retail, all are being restructured and reducing their labor needs due to technology.

We are not in a recession, we are in a reordering of our labor world. The biggest reflection is not in the employment numbers but in the wage figures, which have been on the decline since 2001 when compared to inflation. The job losses are occurring because we could not adjust enough through lower wages.

And you have to ask yourself how far wages drive down before the system doesn’t work like it used to. Most people in China are not paid enough to afford the goods that they make and if our wages have to decline to meet theirs, then when does the system stop working? And when do we get to the point where we can’t afford the basics for living like we have? When does the cost of modern life outpace the wages that you can make when you are in direct competition with someone willing to work in a dirt floor hut?